Canara Bank Personal Loan

Meet all your financial issues in a go with Canara Bank personal loan. Canara Bank provides multiple loan options at an affordable rate of interest. You can instantly apply for the Canara Bank personal loan in just a few mouse clicks. Apart from affordable interest rates and instant online application, there are numerous other benefits which come with Canara Bank loans such as easy documentation, basic eligibility criteria and a lot more. So, it is one of the best loan options to meet your instant financial needs.

Reason to take Canara Bank personal loan

Canara Bank has always succeeded in providing some of the best personal loan offers to meet your instant need for funds at low interest. Various discounted personal loan schemes has helped people to get loan easily as per their requirements. Some of the major benefits associated with Canara Bank personal loan are listed below

- Low rate of interest

- Loan in bulk

- No Guarantor required

- Instant loan processing

- Discounted loan schemes

- Specialized loan offers

- Long repayment tenure

- No pre-closure charges

- Instant support services

Canara Bank Personal Loan Interest Rate

Know Key-Features of Canara Bank personal loan

Canara Bank provides personal loan at quite an affordable rate of interest so that you can live your dreams and meet your financial requirements easily. In addition, the bank also offers multiple loan schemes for the borrowers falling in the special category. There are numerous benefits of taking personal loan from Canara Bank; some of the major benefits are listed below –

Low rate of interest

The interest rate charged by Canara Bank is quite low which makes the loan an affordable option for you. The rate of interest on personal loan starts from 10.99% only.

Loan in bulk

Canara Bank provides heavy funds as a loan amount so you can easily get as much money as required for making your dreams come true. The maximum amount available as a personal loan is around 10 lac.

No Guarantor required

To get your personal loan approved at Canara Bank, you do not need any guarantor so you can easily get the loan approved without any dependency.

Instant loan processing

There is almost no delay in the processing of your personal loan application with Canara Bank. Your loan application is instantly processed and funds are disbursed quickly as the bank has a localized system of loan approval and funds disbursal.

Discounted loan schemes

Canara Bank comes with numerous seasonal loan schemes and offers loan at discounted rates. These schemes are available for almost all of the applicants so you can easily get loan at lower rates during the festive seasons.

Specialized loan offers

Canara bank also provides specialized loan offers to meet the varying requirement of different applicants so, you can easily get personalized loan in accordance to your need.

Long repayment tenure

The repayment tenure of loan is completely dependent upon the availability of funds in future. You can easily repay the loan over the long period of time extending up to 5 years.

No pre-closure charges

If you have funds to repay your loan then you can do it instantly without paying any additional pre-closure charges. Canara Bank charges absolutely no pre-closure fee.

Instant support services

Canara bank has 24*7 helpline services so you can anytime get in touch with the officials and get all your queries answered instantly.

Canara Bank Personal Loan Fees & Charges

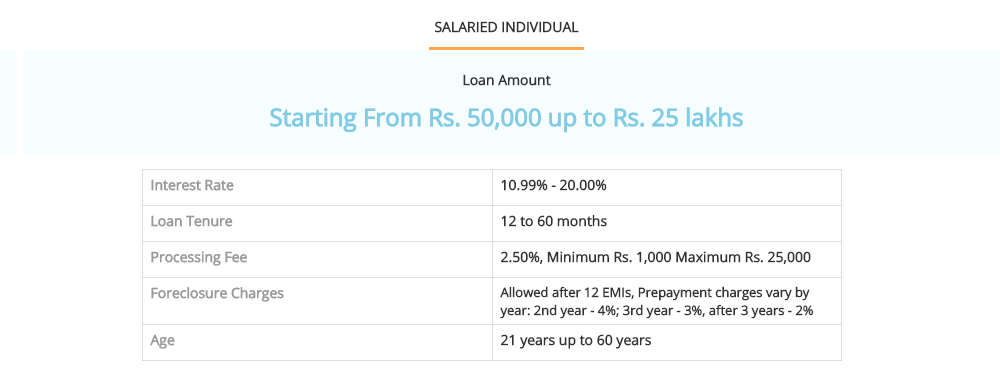

| Loan Processing Fees | Up to 2.50% of loan amount, Rs 1,000 to 25,000 |

|---|---|

| Pre-payment Charges | 4% of principal outstanding - 13 to 24 months, 3% of principal outstanding – 25 to 36 months 2% of principal outstanding - >36 months |

| Penalty for late EMI payment | 24% per year on outstanding amount From default date |

Are you eligible to apply for Canara Bank Personal loan?

If you want to apply for personal loan then as an applicant you must meet the basic eligibility criteria. Let’s know the eligibility criteria to apply for Canara Bank personal loan -

If you want to apply for Canara personal loan then you must be amid 22 to 60 years of age.

You should either be a self-employed professional or salaried employee with consistent monthly income.

You should have 2 years of working experience or you are running a business for the same time span.

Your monthly income should meet the minimum income requirement.

Essential Documents for Canara Bank Personal Loan

Loan Application

You need to provide a duly filled loan application form

KYC Documents

PAN/Driving License/ Voter ID/Photograph

Proof of Income

Bank statement of last 6 months/ ITR for last two years

Proof of Business Continuity/Employment

Form 16/ Income Tax Return

Why to apply for Canara Bank loan at Rupee Station?

Rupee Station is a one-stop platform for getting a loan in just a few days. Rupee Station allows you to apply for the loan in just a click just by filling up an easy loan application form. We make funds available even to applicants with poor credit history so, anyone can get the loan instantly with Rupee Station.

At Rupee Station, we enjoy an exclusive collaboration with Canara bank so you can avail special scheme and offers of the bank. Thus, you can get Canara bank personal loan at an affordable interest rate with Rupee Station. Let’s know the benefits of applying for loan at Rupee Station -

Apply for loan in a click

At Rupee Station, you can apply for the loan in just a few clicks, as all you need to do is fill an online application form with some of your basic details.

Instant loan approval

Once you fill the application form, our financial experts will get in touch with you and will get your loan approved instantly.

Quick Disbursal of loans

The loan amount is disbursed to your account in just two days after the approval of your loan application.

Instant customer support

We have a dedicated customer support team which is always available to answer your queries regarding the personal loan and its application procedure.

Real-time application tracking

We also provide the facility to know the real-time status of the loan application. You can easily track your loan application online with our real-time loan application tracking facility.

How to get loan instantly at Rupee Station?

With Rupee Station, you can get loan instantly in just a few minutes. Let’s know the steps to apply for loan at Rupee Station –

Step 1

Fill an easy loan application form at Rupee Station.

Step 2

Your loan application will be instantly reviewed by our financial experts.

Step 3

Get funds in just a couple of days, on the approval of your loan application.

About Canara Bank Personal Loan

Canara Bank Personal loan is easily available in just a few days, so you can meet your urgent financial needs. No guarantor or collateral is required for the approval of the loan. In addition, the rate of interest charged by the bank is also quite affordable.

Why choose Canara Bank Personal Loan?

If you are in need of funds and planning to procure the same through loan then apply for Canara Bank Personal Loan as it is available at a low rate of interest. In addition, the repayment tenure is also quite flexible, there are no-pre-closure charges, and the loan is available in bulk.

Canara Bank Personal Loan Interest Rates (2018)

The current rate of interest charged by Canara Bank on personal loan starts from 10.99% only.

Canara Bank Personal Loan Eligibility Criteria

The eligibility criteria to apply for the Canara Bank Personal Loan are very basic and almost everyone is eligible to apply for the loan. Your age should be amid 21 to 65 years of age, your monthly income should meet the minimum monthly requirement of the bank, and you should be the citizen of India and so on.

Canara Bank Personal Loan EMI calculator

You can easily know the expected monthly installments by making use of online EMI Calculator at Rupee Station. You are just required to provide some basic information such as your monthly income and the loan amount required in order to know your lowest monthly installments.

Free Credit Score/ Rating Report

The unsecured personal loans are approved on the basis of your credit score, so you should know your credit score even before applying for the loan. At Rupee Station, you can check your credit rating instantly with our free credit score checker. In addition, you can also get a detailed credit report to know your credit worthiness. The report will also contain some instant and basic tips to improve your credit rating.

Personal Loan Terms and Conditions details for Canara Bank

There are very basic terms and conditions associated with Canara Bank Personal Loan. You should have a good or average credit rating, you should meet all the basic eligibility criteria, and you need to represent the essential documents.

Canara Personal Loan procedure and approval time

At Rupee Station, the procedure to apply for the personal loan is very simple. You just have to submit a loan application form available at our website. With us, your loan will be approved instantly in just a few days and the loan amount will be disbursed within 2 days after the approval of the loan.

Canara personal loan online payment process

You can easily make all the payments related to your Personal loan online in minutes only. In addition, the loan amount will be disbursed directly into your account.

How to Apply for Canara Bank Personal Loan?

You can easily apply for Canara Bank Personal loan by filling an online application form at Rupee Station. Just provide some of your basic details and your request for the loan will be initiated instantly. Thus, you can easily apply for the loan in just a few clicks.