Union Bank Personal Loan

Are you planning to a take personal loan? Then Union Bank personal loan is amongst one of best options for you. Union Bank of India is the government owned bank as the major part of its share capital is owned by the government. In order to meet the financial needs of different customers, Union Bank offers different loan options such as educational loans, personal loans, home loans and a lot more.

With Rupee Station, you can instantly meet your financial requirements as Rupee Station helps you to get your loan application approved quickly through online processing. You can easily apply for Union bank personal loan by applying online. Just fill up a simple form with your basic details at Rupee Station and you are almost done with the procedure of applying for Union Bank personal loan.

Benefits of taking Personal Loan from Union Bank

There are numerous benefits of applying for the personal loan at Union Bank of India, some of the major benefits are listed below, and have a look:

- Quite a low rate of interest

- No requirement of collateral for the loan

- Different type of personal loan to suit varying requirements

- Easy and quick loan approval

- Flexible repayment tenure

- Online loan processing

- Low or almost negligible loan processing charges

- Loan approval within a short span of 3 years

- Quick disbursal of money, once the application is approved

Union Bank Personal Loan Interest Rate

Best Features of Personal Loan offered by Union Bank

The personal loan offered by the Union bank comes with quite a low rate of interest. The best part is that Union bank also provides some offers for the borrowers which fall into special categories. The personal loan offered by Union Bank comes with multiple salient features which help customers to reap the maximum benefit from the loan and also make them experience an effortless loan procedure. The major features of Union Bank personal loans are –

No Need of Collateral

For availing personal loan from Union Bank, you do not need any collateral. There is no need of any type of security for availing the personal loan from Union Bank.

Low rate of interest

Union Bank offers personal loan at quite a low rate of interest. Union Bank charges up to 14.40% on personal loans.

Available for All

Union Bank offers the personal loan to the salaried employee as well as to the self-employed professionals. So, no matter to which category you belong, you can easily avail the personal loan.

Flexible repayment tenure

You can decide the repayment tenure of your loan as per your convenience. You can extend the tenure of repayment amid 12 months to 60 months. So, if you want to give small EMIs, you can easily do the same.

Low processing fee

The personal loan processing charges are also too low so you need not pay much even before getting the loan.

Easy procedure

The process of applying for the personal loan at Union bank is too easy as you just need to fill an online form on Rupee Station. Once you are finished with the online application form, you will receive a call from our representative and he will take the process ahead.

Quick disbursal of funds

Once your loan application is approved by the Union bank, the funds are made available in just a few days so you can easily meet your instant fund requirements.

Pre-closure and part payment

Union bank also provides the option of part-payment and pre-closure so, if you have money to pay off your loan, you can easily do the same.

Instant Customer Support

In case you have any query related to your loan application or any other financial product offered by the bank then you can get in touch with the customer support team and get an instant solution.

Union Bank Personal Loan Fees & Charges

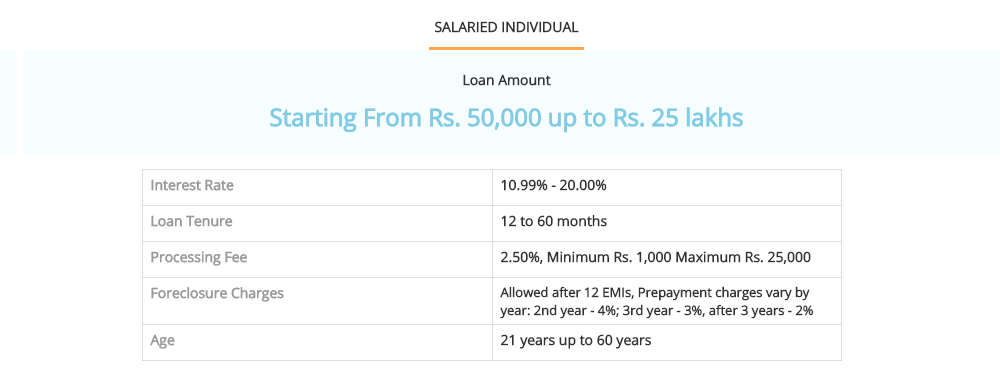

| Loan Processing Fees | Up to 2.50% of loan amount, Rs 1,000 to 25,000 |

|---|---|

| Pre-payment Charges | 4% of principal outstanding - 13 to 24 months, 3% of principal outstanding – 25 to 36 months 2% of principal outstanding - >36 months |

| Penalty for late EMI payment | 24% per year on outstanding amount From default date |

Eligibility Criteria of Union Bank Personal Loan

You can easily apply for the personal loan at Union bank as the eligibility criteria are quite a basic one. Below given are the eligibility criteria for Union bank personal loan –

You should have a consistent source of Income.

You should be a resident of India with minimum 21 years of age.

You should be the customer of Union bank i.e. you must have an account in this bank.

You should be left with sufficient years of service in order to repay the loan.

Documents Required for Union Bank Personal Loan

Loan Application filled with all the details

– Duly filed loan application should be provided

Identity Proof

– Passport/ Aadhar card/ PAN Card/Employee identity card

Address Proof

- Electricity bill/ Aadhar Card/ Telephone bill

Income Proof

- ITR of last year/ Salary slip of last six months /letter from employer or form-16

Photographs

- 3 recent photographs

Why to Apply for Union Bank Personal Loan at Rupee Station?

Rupee Station is one stop solution for business and personal loans. You can easily apply for the loan in just a few clicks and get the loan of required amount at a low-interest rate. Rupee Station enjoys an exclusive collaboration with Union Bank to help its customers get the best loan offers and interest rates. If you are planning to take a personal loan from Union bank then just fill up an easy form at Rupee Station and get the loan in just a few days. Below given are some reasons which will tell you why it is good to apply for the loan at Rupee Station, have a look –

Personalised Loan options

The requirement of loan differs from customer to customer so in order to meet the varying requirements of our customers, we offer personalized loan options.

Quick and Easy process

The process of applying for loan is too easy and simple at Rupee Station as you are just required to fill some basic details in our online form and you are done.

Quick Fund availability

Once you have filled the form, your application will be reviewed by our officials and if it is approved then you will get the funds in a minimum of 2 days.

Track your loan application

You can also track the status of your loan application in just a few clicks at Rupee Station as we provide real-time application tracking option.

Instant Support for Customers

All your queries related to your loan application is answered instantly by our highly dedicated customer support team.

What is the Process to Apply at Rupee Station?

Applying for the personal loan at Rupee Station is quite a simple and an easy process.

Step 1

Fill the form with your basic details at Rupee Station.

Step 2

Our representative will connect with you to inquire about other relevant info.

Step 3

Get the loan amount in just 2 days, if your application for the personal loan gets approved.