Vijaya Bank Personal Loan

Vijaya Bank offers Personal Loans to the borrowers that enable the applicant to finance their expenditures. Personal Loan at Vijaya Bank is called “V Cash." V-Cash is a Personal Loan scheme that is intended primarily to satisfy short-term credit needs of an individual, working women, pensioners, senior citizens. The applicants are allowed to take the loan for meeting unforeseen requirements, medical expenses, marriage function, Etc. Such loans from Vijaya Bank can assist in many discretionary expenses. Personal loans from Vijaya Bank are readily available through minimal documentation and low-interest rates.

Reasons to choose Vijaya Bank for Personal Loan.

The idea to obtain a Personal Loan from a bank is to have minimum stress and maximum benefits. Therefore the reason an individual should choose Vijaya Bank for loans are:

- The advantage of obtaining a loan is that it provides same interest throughout the duration

- Easy documentation is needed, and the Personal Loan in Vijaya Bank gets processed faster

- The applicant can pay off the loan in secure installments every month and can repay it via auto debit, PDC or ECS

- The bank provides with no additional charges

- Particular interest rates for women borrowers

- It offers its customers with Quantum of Finance.

- The advantage of fast loan processing is a merit

- It gives flexible loan repayment tenure starting from 12 to 60 months

- The maximum loan which is provided by the bank is up to Rs. 40 lakh for salaried individuals

- Disbursal of money within two days

Vijaya Bank Personal Loan Interest Rate

Features of Personal Loan in Vijaya Bank

Vijaya Bank offers Personal Loan provides a loan to the individuals so that they can fulfill their dream and get personalized solutions and services. The main features on which Vijaya bank runs on are as follows:

Interest Rates

Vijaya provides competing interest rates on personal loans. It is offering an interest rate of 12.90% per annum. It can also vary from an individual to an individual depending on the credit score which he/she contains.

Loan Amount

Vijaya Bank provides with maximum loan amount disbursed in the bank. It has been offering a total amount up to Rs 40 lakh to all its applicants. This is the maximum loan amount donated by the bank to the customers.

Less processing time

The time taken to process and disburse the loan amount by Vijaya Bank is a maximum of three days. It is a speedy process. The applicant can visit our site to check the eligibility and documentation of the same.

Special interest rates for women

Vijaya Bank provides special offers for women. Personal Loan Diva is one of the advantages for all the working ladies out there who are on a hunt to achieve their dreams. They can take a pre-approved personal loan up to Rs. 3 lakh. The procedure to avail this offer is straightforward. The applicant needs to intimate the bank through a call or email.

Online application and customer friendly service

It is always a feasible idea to save time as well as money by opting for the option of the online form. It is fast, reliable and straightforward to use. If the user thinks that they are having trouble with the way, then they can always contact the customer services which are available 24/7.

EMI calculator

EMI or Equated Monthly Installments is to take loans on EMI basis. If the customer wants the credit on EMI basis, then they need a tool for EMI calculations. So Vijaya Bank has provided the EMI calculator to calculate the EMI per month. If the user has EMI Calculator, then they can quickly decide the loan amount within seconds. The user can check the EMI loan details for various loan amounts.

Insurance Cover

The applicants can get an insurance cover along with the Personal Finance scheme for a nominal premium. It provides the applicants with an accidental cover up to Rs. 8 lakh. Besides this, the user can also get cover for a critical illness up to Rs. 1 lakh.

Guarantor

The Bank provides with outstanding offers in term to loan sanction. The applicant needs to have a guarantor to obtain a loan from Vijaya Bank. Loans sanctioned to others might not require a guarantor.

Special schemes

Vijaya Bank gives customized Personal Loan interest rates and plans for a particular category of borrowers. Borrowers who are working in reputed companies, banks or government employees, etc. Some of the unique personal loan schemes of Vijaya Bank are:

• Loan for Meeting Urgent Conditions

• Personal Loan to Pensioners

Vijaya Bank Personal Loan Fees & Charges

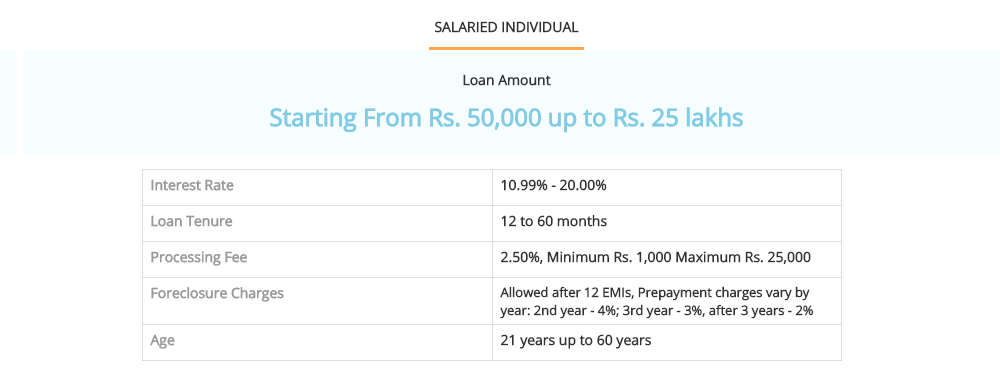

| Loan Processing Fees | Up to 2.50% of loan amount, Rs 1,000 to 25,000 |

|---|---|

| Pre-payment Charges | 4% of principal outstanding - 13 to 24 months, 3% of principal outstanding – 25 to 36 months 2% of principal outstanding - >36 months |

| Penalty for late EMI payment | 24% per year on outstanding amount From default date |

Eligibility Criteria for Personal Loan at Vijaya Bank

Salaried or Pensioner : The candidate should be a salaried person or should be a pensioner with a steady source of pension.

Age Limit : The candidate has to be at least 21 years old and should be less than 56 years old, in case of salaried people. The exit age for pensioners is 72 years.

Service : Salaried candidates should have at least four years of service left. Minimum 2 years of work experience in case of self-employed, minimum two years of business continuity

Salary Certificate : The candidate needs to furnish the latest salary certificate to be eligible for a Vijaya Bank Personal Loan. Special pre-sanction records would be required before the loan is granted.

Valid ID proof : This could be any government approved photo ID card.

Documents Required for Personal loan at Vijaya bank

Income Documents

For Salaried individual

• Three years of pay slip.

• Six months salary account slip.

• Bank statement and latest year form.

For Self-employed individual

• Latest two years ITR

• Financial Records (balance sheet, schedules to balance sheet and tax audit report) and six months company account statement is required.

• The current obligations, i.e., the other installments (EMIs) should be currently paying, the number of credit cards and credit limits that is there or have been used.

KYC Documents

Pan Card, Secondary ID Proof (DL, Adhaar card, Voter's ID) & Passport size photo

Proof of Employment/Business Continuity

For salaried individualAppointment letter, dated two years or earlier period

For Self-employedITR or Sales/Service tax registration certificate, dated two years or more prior period

Property Documents

Under construction property

Allotment letter, proof of booking amount paid and payment schedule

Ready Property

Sale deed, parent documents, property tax paid certificate (latest)

Self-construction

Sale deed, parent documents, khatha (7/11 extract) and latest EC

Reasons to apply for a Personal loan at Rupee Station

Offering personalized loan offers

At Rupee Station, the applicant can receive personalized loan offers and excellent deals at the best rate of interest. It is due to a tie-up with Vijaya Bank, which assists the applicants to get the best deal on the personal loan as per the profile stated.

Quick Approval

The applicant would get instant approval on the personal loan after they fill in a simple online application form.

Disbursal within two days

As soon as after the loan is accepted, the funds are transported right into the borrower’s bank account within two working days. Thus we do not believe in delay.

Facility of real-time tracking

After docility of the loan application at Rupee Station, the user can trace the application online and moreover, will accept updates of the submitted application form using both email and SMS.

Customer Support Service

Rupee Station has a customer support team which is passionate and dedicated. The helpline is forever ready to help with any grievances or questions from the applicants.

Procedure to apply

Step 1

Fill in the application form

Step 2

We would go through the application form and review it by answering the application form in some time.

Step 3

The cask is transmitted within few days.

Vijaya Bank Personal Loan Details

Vijaya Bank offers a high quantum loan up to 40lac in just a few days to the borrowers, so that they can easily meet their instant requirement of funds. The interest rates charged by the bank are quite minimal and the repayment tenure can be extended up to 60 months. There are special interest rates for women and other borrowers falling under a special category.

Vijaya Bank Personal Loan Eligibility Criteria

Anyone can easily apply for the Vijaya Bank Personal Loan as the eligibility criteria are quite minimal. In order to be eligible to apply for the loan, you should have the citizenship of India, a regular source of income, your age should be 21 years or more at the time of application and at the maturity of the loan, your age should be 65 years or less.

Documents Needed for Vijaya Bank Personal LoanThe documentation process is also hassle-free as you can easily submit the documents online and only some basic documents are required by the bank. These documents include identity proofs, income documents, bank statements and so on. So, you can easily get your personal loan approved by Vijaya Bank.

Vijaya Bank Personal Loan Interest Rate

Vijaya Bank offers a highly competitive rate of interest in order to make the personal loans available at quite a low cost. The interest rate charged by Vijaya Bank starts just from 12.90%, so you can easily get the high quantum loan at low rate of interest.

Apply Online Vijaya Bank Personal Loan at Low-Interest Rate

You can easily apply for the Vijaya Bank Personal Loan online at Rupee Station and get the lowest rate of interest. At Rupee Station, you only need to fill a short application form at our website in order to apply for the loan. We have a team of highly experience financial experts who compare the different loan offers and provide you the one with the lowest rate of interest.

Check Online Vijaya Bank Personal Loan EMI Calculator, Eligibility, Application Form and Fee.

At Rupee Station, you can easily complete the entire loan process online in minutes. Just fill the loan application form available at the website and your loan process will be initiated in minutes. In addition, you can also check the expected EMIs using our online EMI calculator as well as you can know your eligibility for the loan in clicks only.

Vijaya Bank Car Loan

You can also take the Car Loan from Vijaya Bank and get your new car by just making the down payment of 15% of the total invoice value of the car. The bank provides up to 85% of the invoice value of the car as the loan amount. The interest rate for the Car Loan starts just from 10%. In addition, the repayment tenure can be extended up to 84 months, so you can repay the loan in accordance with your monthly income.

Vijaya Bank Gold Loan Interest Rate

The bank also provides the Gold Loan to the borrowers at the interest rates starting just from 7%. Anyone who owns gold and is amid 21 to 70 years of age can apply for Vijaya Bank Gold Loan. The repayment tenure for this loan is up to 2 years and the margin rate ranges amid 25% to 30%. The best part is that the documentation process is also quite minimal, and thus the loan is available in just a few days.