Uco Bank Personal Loan

UCO bank is one of those banks which is specially planned to expand any financial assistance for a legitimate purpose to the borrower at any point in the financial crisis. It may include medical expenses, commercial liability, wedding, social obligation, etc. It offers exciting financial products to their customers. Moreover, UCO Bank with its striking personal loan schemes provides financial support for all the sectors together with small and large scale industries, agricultural and farming areas, service, infrastructure and trading sectors. .

Reasons to choose UCO bank for Personal Loan

- The benefit of the loan is that it provides with same interest throughout the duration.

- Easy documentation is needed and then is the personal investment in UCO Bank gets processed.

- The customers can disburse off the loan in simple installments every month and can repay it via auto debit or PDC or ECS.

- UCO bank has the feature where it offers competitive pricing to the applicants.

- When it comes to a Personal loan, the disbursal period is just two days.

- The process is a transparent procedure.

- The user can apply online for UCO Bank Personal Loan and get loan approval within 4hrs.

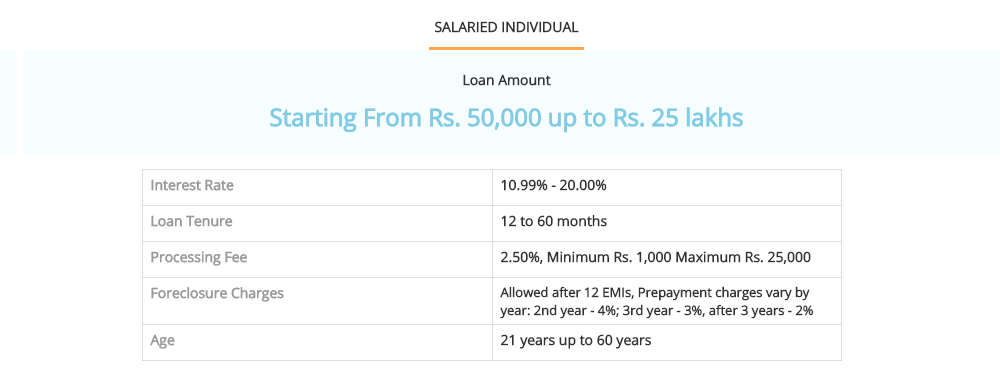

- UCO bank provides with a maximum loan up to Rs. 25 lakh for salaried individuals.

- Flexible repayment options which range from 12 to 60 months.

Uco Bank Personal Loan Interest Rate

Features of Personal Loan at UCO bank

Repayment capacity

UCO Bank looks after a person’s repayment capacity before providing them a loan and before deciding the interest rate. The bank would make sure that after paying the EMI, the user will have enough money left for the rest of the month. The bank also sees the borrower’s assets and the creditworthiness.

Borrowing class

Banks favor giving loans to those who have a steady income. UCO Bank offers a personal loan to permanent employees, self-employed, businessmen, and pensioners. They offer a loan with minimum documentation and fast verification of the data.

Low-interest rates

UCO Bank provides outstanding interest rates for its customers and their applicants. The interest rate begins from 10.99% and goes up to 20% depending on the credit score of applicants.

Exciting offers for women applicants

With the Personal Loan designed especially for women, UCO Bank offers a unique loan scheme to women employees. It provides with plans which are suitable for working women to achieve their needs and goals. They can take a personal loan of up to Rs. 3 lakh. The process to avail this tender is straightforward – the applicant needs to cherish the bank through a call or email. A unique number is generated which the applicant needs to send via email. It is then processed simultaneously.

No collateral or Security

The applicant who wishes to seek personal loan at UCO bank does not require any collateral or security assets to apply for the loan. No other bank provides such feature to their customer. There is no demand to pledge any collateral or security up to the loan amount.

Online form

The applicant who does not wish to come down to the bank and apply for the loan can always do it online. Online application forms are available for the customers to fill it up at their home without wasting time and money.

24/7 customer service

The applicant has the advantage of efficient customer support throughout the lending procedure. They can contact the customer desk of the bank via a call or message. The user does need to visit the bank physically as all the loan paperwork can be completed online with ease.

Time limit

The loan requests to be repaid in equated monthly installments or EMI’s. The Bank is flexible and easy when it comes to repayment tenure; however, the maximum time limit to entirely repay the loan is 60 months. The borrower can settle on to either increase the EMI amount or pay off the mortgage faster or lower the EMI amount. The Bank charges a little processing fee.

EMI calculator

It’s simple to calculate the EMIs with the help of a personal loan EMI calculator online of UCO Bank. For calculating the loan, the user has to put the amount, tenure and interest rate in the calculator. Once the values are entered, the user will see the calculations of EMIs, interest and the overall liability.

Uco Bank Personal Loan Fees & Charges

| Loan Processing Fees | Up to 2.50% of loan amount, Rs 1,000 to 25,000 |

|---|---|

| Pre-payment Charges | 4% of principal outstanding - 13 to 24 months, 3% of principal outstanding – 25 to 36 months 2% of principal outstanding - >36 months |

| Penalty for late EMI payment | 24% per year on outstanding amount From default date |

Eligibility Criteria for Personal Loan at UCO bank

An established employee in semi-Govt. /Govt. / private Ltd. Co. /public sector/College/universities undertaking or the candidate should be a permanent employee. It is necessary to have completed minimum three years of service in the same organization and having a salary tie-up agreement.

UCO Bank eligibility is based on the age of the applicant as it is used to calculate the maximum loan tenure for which UCO Bank will provide a loan. A more extended tenure loan would result in lower. UCO Bank offers credit to salaried employees between the age of years to years

UCO Bank will calculate the loan tenure. If the applicants are eligible based on the age and interest rate, then they are available based on the income. The factors are also used to calculate the personal loan eligibility. Higher the loan tenure lower will be the EMI and thereby, higher will be the loan eligibility. Similarly, lower the interest rate, lower will be the EMI which would result in a higher loan eligibility

The earning should be a minimum income of Rs. 12,000/- per month net income and a net profit of Rs. 15,000/- in case of Mumbai, Delhi, Bangalore, Chennai, Calcutta, Ahmedabad and Cochin

Documents Required for Personal Loan at UCO bank

- Appropriately filled in application form with photograph

- Identity proof and residence proof

- Latest three months bank statements with processing fees cheque.

- Most up-to-date salary slip and current dated salary certificate with the newest form starting from 16 for salaried persons

- Latest bank statement and latest ITR

- Current obligations, i.e., the other installments (EMIs) you are currently paying, the number of credit cards and credit limits you have or use

- Pan Card, Secondary ID Proof (DL, Adhaar card, Voter's ID) & Passport size photo

- Other documents may also be required as per bank’s guidelines.

Reasons to apply for Personal Loan at Rupee Station

Presenting with personalized loan offers

At Rupee Station, the user can receive personalized loan offers and excellent opportunities at a vigorous rate of interest. It is due to a tie-up with UCO Bank, which benefits the user to get the best deal on the personal loan as per the profile.

Bring with instant approval

The user will get instant approval on the personal loan after they fill in a simple online application form.

Disbursal within two days

As early as the loan is approved, the funds are transported right into the borrower’s bank account within two working days.

The facility providing real-time tracking

After the user has submitted a loan application at Rupee Station, the user can track the application online and moreover, will receive updates on the proposed application form using both email and SMS.

Customer Support

Rupee Station has a dedicated customer support team and helpline which is continuously ready to help with any complaints or questions from loan applicants.

Steps to apply for Personal Loan at Rupee Station

Step 1

Fill in the application form.

Step 2

The application form is reviewed and verified. Depending upon which the user is then approved for

Step 3

The cash is disbursed between few days.