Idbi Bank Personal Loan

Finance your dreams in just a few clicks with IDBI bank personal loan. If you are facing a financial issue in living your dreams then IDBI Bank is here to provide you with the money. IDBI is amongst one of the renowned commercial banks in India. The Bank offers multiple financial services and products where personal loans are one of the most preferred options for customers.

You can easily apply personal loan from IDBI bank in just a few clicks through Rupee Station.. You just need to fill a loan application form at Rupee Station and you are done with the process of applying the personal loan.

Why take personal loan from IDBI?

IDBI is a well established bank with its branches in different parts of the countries as well as in different parts of the world. Today, the bank has become one of the best option for personal loan as IDBI personal loan comes with multiple benefits some of them are listed below.

- Multiple loan schemes

- Basic eligibility criteria

- Large sum available as loans

- Instant and quick documentation process

- Flexible repayment tenure

- Bad credit personal loan available

- Apply for loan in just a few clicks

- Part-payment and pre-payment options

- Top-up loans available

Idbi Bank Personal Loan Interest Rate

Key-highlights of IDBI Bank Personal Loan

Over the years, IDBI Bank has successfully met the requirements of their customers and helped them to resolve their financial issues in just a blink of an eye. IDBI personal Bank loans are easily and instantly available, so you can meet your financial demands in just a couple of days. The best part is that the banks offers numerous schemes and offers to their borrowers to make the loan available at affordable prices. Below listed are the key-highlights of IDBI bank personal loan, have a look –

Varying loan schemes for borrowers

IDBI Bank offers multiple different loan schemes to meet the varying requirement of their customers. In addition, different loan offers are also available which makes the personal loan affordable to customers.

Low Interest Rate

IDBI personal loan interest rate is comparatively low starting from 10% and ranging up to 13%

Bulk funds available

You can easily meet your heavy financial expenditures with IDBI Bank personal loan as heavy principal is available as a loan. You can easily get amount up to 10 lac from the bank.

Basic Eligibility Criteria

The eligibility criteria for getting the loan is very basic at IDBI so any individual whether salaried or self-employed can easily apply for the loan.

Top- up loans available

With IDBI bank you also get the facility for top-up loan which allows you to take the extra amount as a loan. So, in case you need extra funds, you can easily get some extra funds.

Make part-payment or Pre-payment

If you have want to pay off your loan early than your specified period of time then you can also make pre-payment or part payment.

Flexible repayment tenure

You can decide the term of repayment of loan depending on your future cash inflows. You can extend the repayment tenure up to 36 months.

Free insurance cover

IDBI bank provides free personal accident Insurance cove to the borrowers which proves to be a boon in emergency.

Minimal processing fee

The personal loan processing fee is very minimal with IDBI bank so you need not pay much for getting the funds in your account. The bank charges only 1% of loan processing fee from the customers.

Idbi Bank Personal Loan Fees & Charges

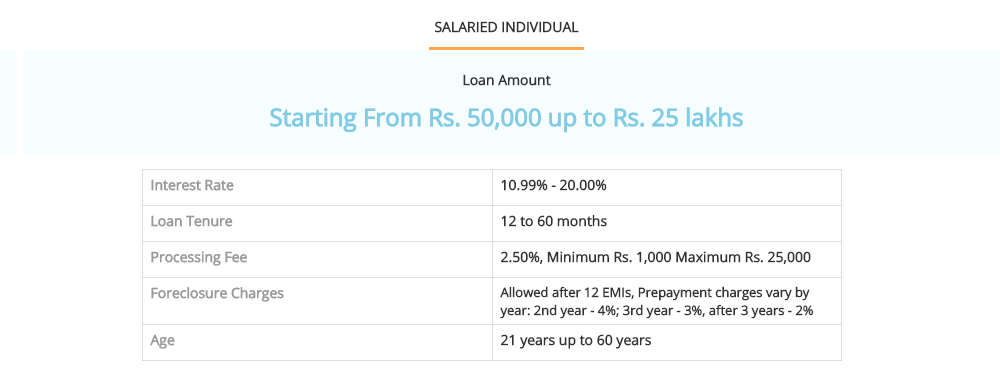

| Loan Processing Fees | Up to 2.50% of loan amount, Rs 1,000 to 25,000 |

|---|---|

| Pre-payment Charges | 4% of principal outstanding - 13 to 24 months, 3% of principal outstanding – 25 to 36 months 2% of principal outstanding - >36 months |

| Penalty for late EMI payment | 24% per year on outstanding amount From default date |

IDBI Bank Personal loan Eligibility Criteria

IDBI Bank has set very minimal criteria to become eligible for their personal loan so anyone can easily apply for the loan. Below given are the basic eligibility criteria of IDBI Bank Personal

In order to apply for IDBI Bank personal loan, you should age amid 22 years to 60 (Salaried individual) / 75 (Self-employed professionals) years.

You should have a consistence source of income so either you should be a self-employed professional or salaried employee.

Your monthly income should be more than the minimum income requirement for the loan.

You should maintain an account with IDBI Bank (whether Salary, pension or liability).

Required Documents for IDBI Bank Personal Loan

Duly filled Application

You need to provide a duly filed loan application form with photograph

ID Proof

Voter ID/Driving License/Passport/PAN

Income Proof

Latest filed ITR or Form 16

Bank statement

Previous 3 months bank statement/ bank passbook for previous 6 months

Apply for IDBI Personal Loan at Rupee Station

Rupee Station is an online platform for getting a loan in just a couple of days. With us, you can successfully apply for the personal loan in a few clicks and get the funds in your account in just two days. Rupee Station has collaboration with IDBI Bank so you can easily avail offers and schemes making your personal loan an affordable option. Below are some special benefits of applying for IDBI personal loan at Rupee Station, have a loom

Apply loan instantly

You can successfully apply for the loan at Rupee Station in just a few clicks as you only need to fill our online application form with your basic details.

Enjoy Personalized Loan options

You can get the loan in accordance with your need by availing our personalized loan option. This option helps us meet the varying requirement of our customers with ease.

Funds made available in just 2 days

Once your loan application is reviewed and approved, you get the loan amount directly into your account in just 2 days.

Get your query answered in a minute

We have a dedicated customer support team which answer your doubts and queries instantly.

Apply for loan in just 3 steps at Rupee Station

Applying for loan has become way easy with Rupee Station as you can apply for the loan in just 3 simple steps listed below.

Step 1

Fill your basic details in our online loan application form

Step 2

Our financial experts will review your application and will get in touch with you

Step 3

Get funds in your account in next two days

IDBI provides multiple financial products and services to its customers, and has never failed to help in meeting their financial requirements. The bank offers personal loan at a comparatively low rate of interest and highly flexible repayment tenure to help the people meet their financial needs quite easily at affordable rates.

Why choose IDBI Bank Personal Loan?

If you are in search of the loan offers which suits your financial requirements then IDBI Personal Loan can be the option for you. The bank offers the collateral-free personal loan up to 10lac at quite a low rate of interest. The best part is that the eligibility criteria to apply for the loan are very basic, so anyone can easily get the loan.

IDBI Personal Loan Interest Rates (2018)

The current IDBI Bank Personal Loan Interest Rates are much lower in comparison to other banks. In fact, the current rates are starting just from 12.55%.

IDBI Personal Loan Eligibility Criteria

The eligibility criteria to apply for IDBI Loan are also too basic such as you should be minimum 21 years of age at the time of applying for the loan, you should be the citizen of India, you should have a regular monthly income and so on. Thus, almost everyone is eligible to apply for the loan.

IDBI Personal Loan EMI Calculator

You can know your expected monthly installment even before applying for the loan through our EMI calculator in a minute only. To use our online EMI calculator, you just need to provide the basic details which include the required loan amount and your monthly salary.

IDBI Personal Loan EMI Report

At Rupee Station, you can easily get to know the details of expected monthly EMIs. The credit report provides you the detailed information of your installments like the interest amount per month, principal included in the entire installment and so on.

IDBI Personal Loan Credit Score Tool

At Rupee Station, you can easily check your credit score in minutes through our online credit score checker. You only need to submit your basic financial details in order to check your credit score and credit history.

IDBI Personal Loan Terms and Conditions Details

In order to apply for the personal loan at Rupee Station, you must meet our basic terms and conditions such as you must provide a duly filled online loan application form, you must present your KYC documents and so on. Our T&C is quite basic which can easily be met by any person.

IDBI Personal Loan Procedure and Approval Time

At Rupee Station, the procedure to apply for a loan is very simple and short. You just need to fill a form to initiate the request for the loan. Further, our financial experts will take the process forward until the disbursal of the funds. The loan application is approved instantly in only a few days.

How to Apply for IDBI Personal Loan?

You can easily apply for IDBI Personal Loan at Rupee Station in just clicks. Fill and submit the online loan application form available at our website and you are done with the process of applying the loan.