HDFC Bank Personal Loan

Take a level closer to your dream with HDFC personal loans. It is simple to get and nimble to comprehend. HDFC provides Personal loan for various purposes, which includes:

- Travel

- Marriage expense

- House remodeling

- Medical crisis

- Purchase a gadget etc.

It not only provides low-interest rates to the customer but also ensures simplified documentation. Fast approval of loans, no matter the customer is salaried or self-employed and loan starting up to 10.99%.

Reasons to choose HDFC bank Personal Loan:

There are several benefits to avail personal loans from HDFC bank via Rupee Station. We have enlisted a few of the benefits here; you may take a quick look.

- It grants a lower rate of interest

- It provides a higher loan amount

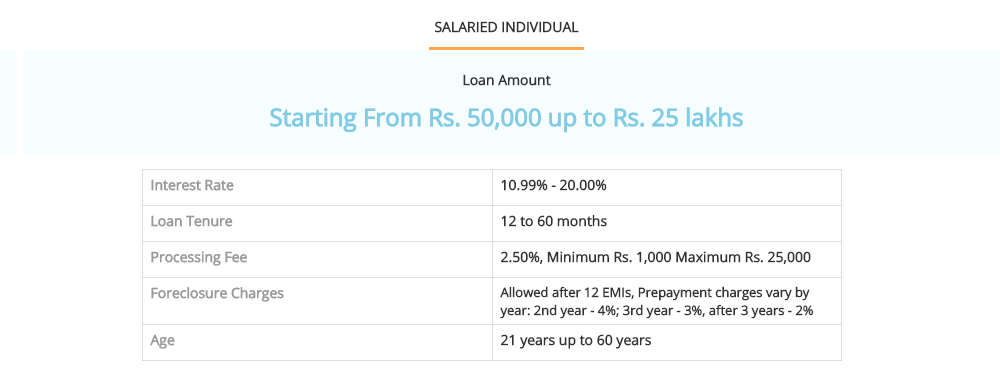

- It presents with the maximum loan up to Rs 25 lakh for the salaried individual.

- It allows a reduction in loan tenure

- It authorizes a reduction in EMI

- It gives flexible repayment options which starts from 12 to 60 months

- It contributes better terms and service.

- Quick dispersal of money in the account within two days

HDFC Bank Personal Loan Interest Rate

Features of HDFC Personal loan

HDFC Personal loan provides various functions to their customer. The key element includes the customization of the Personal loan. It proposes tax-saver deposits and plenty of other FDs. The loan tenure at HDFC is flexible, and the procedure for loan sanctioning is transparent. HDFC bank provides various benefits to the customer. The main features which attract the customer to opt for HDFC Personal loans are:

Low interest rates

HDFC Bank offers a competitive price of interest in personal loan so that one does not feel tight in repaying the loan. Loans from HDFC Bank start as low as 15.75% interest rate for salaried individuals.

Low Prepayment Charges

HDFC Bank proposes substantially lower prepayment charges for personal loans compared to other banks. Prepayment charges are merely removed after 36 months. Therefore, a lower prepayment charges result in a lower burden to the individual paying the loan.

Personal Loan security

The customer can secure their personal loan with HDFC Personal loan security. It provides with various essential benefits which include credit shield cover, and it is equal to the outstanding loan amount. Accidental hospitalization covers up to Rs. 8 lakh in particular.

Easy transferable loan balance

The applicant can transfer the existing Personal Loan to HDFC bank and enjoy lower EMI’s. This saves on the interest payments. The interest rates are as low as 11.39% on the existing loan transfer. The processing fee ranges up to Rs. 1999.

Quick approval

As mentioned above, HDFC bank grants the applicants with less documentation. This is the reason due to which the loan gets quickly approved and that too without any delay. To check the documentation and eligibility criteria, the applicant can check the website.

Online application

The applicant has the option of applying for the loan online. The entire loan procedure can be completed via the website. It not only protects time but it also saves the money as well. The applicant can use the online services of the Rupee Station and get instant approval on Personal Loan.

Instantaneous calculator

The applicant can use the HDFC bank eligibility calculator for a better idea of how the things work. EMI calculator is considered as a great tool to calculate the affordability and plan of the repayment of the loan. The applicant needs to fill in the loan amount, interest rate, and credit term while using the calculator.

Special loans for women

HDFC Bank provides a unique investment for women, and Personal Loan Diva is one such loan which offers schemes to women employees. They can take a pre-approved personal loan up to Rs. 3 lakh. The method to avail this offer is straightforward. The applicant just needs to infer the bank via a call or email. This would lead to a generation of unique diva number and is sent to the registered email id. The applicant needs to confirm the product code and obey the further procedures to avail the offer.

Instant Customer support

If you are availing loans from HDFC bank via Rupee Station, you will be provided with an instant customer support. The experts will guide you at every stage until you receive the amount in your account.

HDFC Bank Personal Loan Fees & Charges

| Loan Processing Fees | Up to 2.50% of loan amount, Rs 1,000 to 25,000 |

|---|---|

| Pre-payment Charges | 4% of principal outstanding - 13 to 24 months, 3% of principal outstanding – 25 to 36 months 2% of principal outstanding - >36 months |

| Penalty for late EMI payment | 24% per year on outstanding amount From default date |

Eligibility Criteria for HDFC for Personal Loan

HDFC bank has laid down several terms and conditions for an individual’s personal loan eligibility. They are as follows:

People who include in the group of salaried doctors, CAs, employees of private limited companies, employees from public sector undertakings, including central, state and local bodies are eligible for the Personal Loan process

The minimum age limit of the individuals should be between 21 and 60 years

The individuals who have had a job for at least two years, with a minimum of 1 year with the current employees are eligible for Personal Loan at HDFC.

Those who earn a minimum of Rs. 15,000 net income per month (Rs. 20,000 in Mumbai, Delhi, Bangalore, Chennai, Hyderabad, Pune, Kolkata, Ahmedabad, and Cochin) is the ones who can apply for the loan

Documents Required for HDFC for Personal Loan

HDFC bank needs various documents for the approval of Personal Loan. Some of the papers which they require are.

Identity Proof: The applicant can provide with anyone of the records.

Valid Passport / Voter ID Card / Adhaar Card and Valid Driving license

Address Proof:

Ration card / Telephone or electricity bill /Rental agreement passport

Income proof

Latest salary certificate with the most recent form

Three months bank statement

Six months passbook

Reasons to apply for Personal Loan at Rupee Station.

The collaboration between HDFC bank and Rupee Station has resulted in an easy and flexible loan service. The applicant can fill the online application if they wish to uphold for a Personal Loan. The main benefits which the applicant can find to apply for Personal Loan in Rupee Station are :

Loan offers can be personalized

The applicants at Rupee Station can sustain customized loan offers and best deals. The reason for such benefit is due to a tie-up with HDFC Bank. It helps the applicant to get a whole deal on the personal loan as per the profile.

Immediate Approval

The applicant would get instant approval on the personal loan after which they can fill in a secure online application form.

Transfer of cash in two days

As quickly as the loan is approved, the funds are transferred immediately to the borrower’s bank account within two working days. Thus, there is no room for delay.

Facility of Real-time tracking

After the applicant has submitted the loan application at Rupee Station, they can trace the application online. The customer will receive updates on the proposed application form using both email and SMS

Customer Support lines

Our customer helpline service is dedicated and available 24/7. Rupee Station has an outstation customer service.

How to apply for the Loan at Rupee Station for HDFC

Step 1

Enter the information by filling up an online loan application form.

Step 2

We will evaluate the application and provide with a decision within minutes

Step 3

You will be receiving the cash within few days

About HDFC Bank Personal Loan

HDFC Bank provides the personal loan to both salaried individuals as well as the self-employed professionals, so anyone in monetary need can easily get the funds from HDFC Bank. The best part is that the rate of interest of HDFC Bank Personal Loan is also very minimal which makes it an affordable option for the borrower.

Why choose HDFC Bank Personal Loan?

HDFC Bank Personal Loan up to 25lac is easily and instantly available along with the highly flexible repayment tenure extending up to 60 months. In addition, the rates of interest, processing fee, and other charges are comparatively lower which makes it one of the most preferred loan options for you.

HDFC Bank Personal Loan Interest Rates (2018)

The current HDFC Bank Personal Loan interest rates are starting just from 15% and ranging up to 20%. So, with HDFC Bank you can easily get the personal loan at a comparatively low rate of interest.

HDFC Personal Loan Eligibility Criteria

The eligibility criteria to apply for the HDFC Personal Loan are quite basic, so anyone can easily meet the same. In order to apply for the same, you should be a citizen of India, your age while applying for the loan should be 21 years and your age at the time of maturity of the loan should be 65 years or less.

HDFC Personal Loan EMI calculator

If you want to keep the monthly EMI quite low in accordance with your monthly income then you can instantly check your lowest expected EMI through our HDFC Personal Loan EMI calculator tool. You only need to submit some basic financial details such as loan amount required and monthly salary in order to know your lowest monthly installments.

Free Credit Score/ Rating Report

Unsecured personal loans are not backed by any collateral, thus the approval of these loans widely depends upon your credit score. You can easily check your free credit score report by using our free credit score checker.

HDFC Personal Loan Terms and Conditions Details

There are not much terms and conditions to apply for the HDFC Personal Loan; you just need to meet the eligibility criteria and repay the monthly installment as decided during the approval of the loan.

HDFC Personal Loan Procedure and Approval Time

At Rupee Station, the procedure to apply for the HDFC personal loan is short and simple. Just fill and submit an online loan application form at our website and your request for the loan is received by our financial experts. The loan is approved in just a few days and the funds are disbursed in only 2 days.

HDFC Personal Loan Online Payment Process

At Rupee Station, the entire loan process is completed online which makes the entire procedure quick and easy. You can easily pay the processing fee along with other charges online in clicks. In addition, the loan amount is also disbursed directly in your account.