YES Bank Personal Loan

Resolve your financial issues easily and instantly with YES bank personal loan. You can easily get the personal loan by applying online through Rupee Station. The loan at Rupee Station is easily available to the self-employed as well as to the salaried professionals. The best part is that you do not have to follow complex procedure or documentation for getting your personal loan approved. On the contrary, at Rupee Station, you just need to provide your basic information such as your name, e-mail ID, phone number, annual income and you are good to go. You must be thinking about the eligibility criteria of YES bank’s personal loan, so to your surprise the eligibility criterion is very basic, and includes age limit, work experience, minimum regular monthly income, residential details etc. You might be amazed to know that at Rupee Station, people with poor credit score are also granted personal loans easily.

Benefits of YES Bank Personal Loan

There are multiple benefits of taking the personal loan from YES bank. Some of the major advantages include

- Highly competitive rate of interest

- Quick approval of loan

- Highly transparent and almost paperless process

- Offers loan from 50,000 to 40 lakhs.

- Flexible EMI options, you can decide the tenure of your repayment

- Instant approval for eligibility

- Quick and easy disbursal of money

- Part pre-payment option also available

- Special rates of interest for female borrowers

- Doorstep banking services to save your time

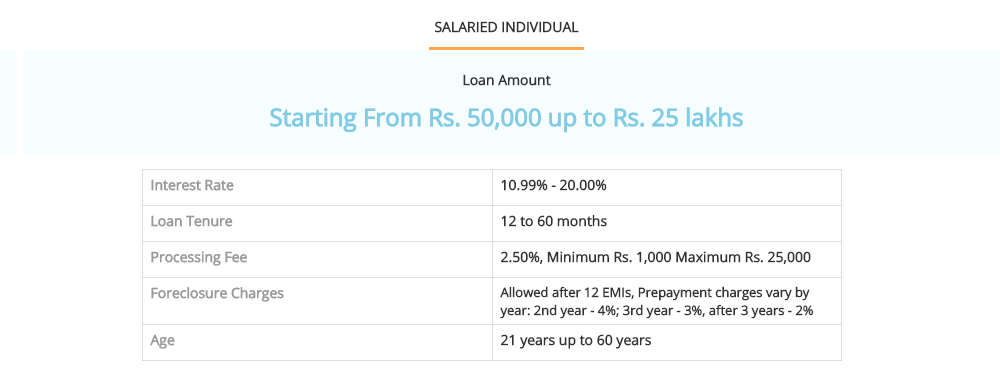

YES Bank Personal Loan Interest Rate

Features of Personal Loan offered by YES Bank

YES Bank personal loan is one of the most preferred loan options of customers these days as this bank offers the loan with minimal interest rates. The best part of the personal loan offered by YES bank is that they also offer customized loans in order to meet the varying requirements of the customers.

YES Bank personal loans come with numerous salient features which not only helps customers to take the maximum benefit of their loan, but also help them to experience a hassle-free loan procedure. Some of the major features of YES bank personal loans are listed below have a look

Highly competitive rate of interest

YES Bank offers highly competitive rate of interest to its customers. The rate of interest is dependent upon the credit score of the applicant but the minimum rate of interest on personal loan is 10.99%

Online Application process

YES Bank allows its customer to process the loan application online, making the entire process hassle-free and paperless. You just need to feed in your details in an online form in order to apply for the loan.

Instant Eligibility Check

You can check your eligibility for loan instantly with YES mPower which is an eligibility calculator tool.

Insurance Cover

Along with the personal loan scheme, insurance cover is also available at a nominal premium for customers. This insurance offers accidental cover and critical illness cover as well.

Quick availability of funds

The funds are made easily available in just a span of a few days. Once your personal loan application gets approved, you will receive the loan amount in a minimum of 2 days.

Part pre-payment option also available

YES Bank also offers part pre-payment option so in case you have some bulk amount to pay off your loan, you can also do the same.

Flexible EMIs

The applicant can select the tenure of repayment of the loan as per their requirement. If you want to be low at monthly EMI, you can easily do the same.

Customer Support

YES Bank provides you with the instant customer support to resolve your query about the loan and other financial products offered by the organization.

Doorstep banking services

In case you don’t have much time, then the representative from YES bank will walk to your doorstep for completing the process of documentation.

YES Bank Personal Loan Fees & Charges

| Loan Processing Fees | Up to 2.50% of loan amount, Rs 1,000 to 25,000 |

|---|---|

| Pre-payment Charges | 4% of principal outstanding - 13 to 24 months, 3% of principal outstanding – 25 to 36 months 2% of principal outstanding - >36 months |

| Penalty for late EMI payment | 24% per year on outstanding amount From default date |

Eligibility Criteria of YES Bank Personal Loan

The eligibility criteria to apply for YES Bank personal loan are too basic. Below listed are the essential eligibility criteria, have a look

You should either be a self- employed person or a salaried employee with age amid 22 to 58 years old.

Your minimum monthly income should be 25000 INR. You should have minimum 2 years of work experience with 6 months of experience at the current place.

In case of rented accommodation, you should have been the tenant for two years at your current resident.

You should have a salary account with YBL as well as you will be required to show ITR for the past two financial years.

Documents Required for YES Bank Personal Loan

Duly Filled Loan Application

– You need to fill the copy of an online application form

Proof of Identity

– Passport/Aadhar card/ Driving license/Voter ID card

Proof of Address

– Passport /Aadhar Card/ Electricity or Telephone bill/ Rent Agreement/ Ration Card

Proof of Income

– Salary slip/Bank statement

Statement of Bank and Form 16

- Copy of your bank statement with the copy of ITR filed.

Why Choose Rupee Station for Yes Bank Personal Loan?

Rupee Station is an online marketplace which offers personal loan at low rate of interest. YES Bank shares an exclusive collaboration with Rupee Station so if you are planning to take a YES Bank personal loan then just fill up our online application form. At Rupee Station, you can apply for the loan in just a few clicks and get the loan at the minimum interest rate. Below listed are few of the reasons why you should apply for a loan via Rupee Station

Personalized Loan Offers

– At Rupee station, we also offer personalized loan option with the minimum rate of interest as we enjoy an exclusive collaboration with YES Bank

Instant Loan Approval

You can get your loan approved instantly at rupee station, just fill the form and our representative will take the process forward.

Fund availability within 2 days

Once your loan application is approved, funds will be available to you in just a short span of 2 days.

Know the status of loan application

Once you have submitted your personal loan application, you can easily get to know the status of your application online as we offer real-time application tracking option.

Instant Customer Support

At Rupee Station, we have a dedicated team for customer support. So, your queries regarding your loan application are answered instantly.

Process to Apply for Personal Loan at Rupee Station

Applying for the personal loan at Rupee Station is quite a simple and an easy process.

Step 1

Fill your details in the application form at Rupee Station.

Step 2

Our representative will call you to know other relevant details.

Step 3

If your application gets approved, you will get the cash in just 2 days.

YES Bank personal loan details

YES Bank is amongst one of the best personal loan providers as it offers loan at interest rates starting just from 10.99%. Loan up to 40 lakhs is easily available without collateral and repayment tenure can be easily extended up to 60 months. Processing fee, part prepayment charges, and other fee is also quite affordable.

Why choose YES Bank Personal Loan?

Interest rate is one of the major factors considered while applying for the loan as it adds to the cost of the loan. The rate of interest of YES Bank Personal Loan starts only from 10.99%. In addition, the bank also provides the top-up loan and numerous other offers to make the loan an affordable option for borrowers.

Check YES Bank Personal Loan interest rate (2018)

The current YES Bank Personal Loan rate for salaried employee starts from 10.99% whereas the rate for self-employed professional starts from 12.49%.

Check YES Bank Personal Loan Eligibility Criteria

If you are planning to apply for YES Bank Personal Loan then at first check your eligibility for the loan. The eligibility criteria to apply for the personal loan is quite a basic one like you should have a regular source of income; your age should be amid 21 to 65 years and so on. Thus, anyone can easily apply for the personal loan with YES Bank.

Free YES Bank EMI Calculator

You can easily repay the personal loan in small EMIs in accordance with your monthly income. If you want to know the expected monthly installment then you can use the free YES Bank EMI calculator at Rupee Station and check your lowest monthly installment instantly.

Free Credit Score checking tool

If you are applying for the personal loan then your credit score will play a vital role as the approval of unsecured loan is dependent upon your creditworthiness. You can instantly know your credit score by using our free credit score checking tool.

Apply online YES Bank personal loan at low interest rate

At Rupee Station, you can easily apply for YES Bank Personal Loan online and get the loan at low rate of interest. We have collaboration with multiple banks and NBFCs, so we make the loans available instantly at low rates.

YES Bank home loan interest rate

If you are planning to purchase a house and falling short of funds then apply for the YES Bank Home Loan and easily buy your dream home. The interest rate of home loan starts from 9.35% only and you can repay the loan in small monthly installments extending up to 25 years.

YES Bank car loan interest rate

You can easily purchase your own car with YES Bank Car Loan. The bank provides car loan at the interest rate starting from 10.25% only. The best part is that the repayment tenure is extendable up to 7 years and the loan is available without any guarantor.