Bank of Baroda Bank Personal Loan

Bank of Baroda is one of the prominent banks in India and offers multiple financial products to the individuals at affordable costs. In order to meet the multiple demands of the customers, Bank of Baroda provides a multi-purpose personal loan. Thus, if you are in need of funds, then Bank of Baroda Personal Loan is one of the best options for you.

Bank of Baroda Personal Loan is an unsecured loan, so you do not need any collateral for availing the loan. In addition, the low-interest rates, easy processing, discounted loan schemes make it one of the best options to meet your financial requirements. You can easily apply for Bank of Baroda Personal Loan at Rupee Station by filling our online loan application form in a minute. At Rupee Station, we also make the loans available to people with bad credit score, so if you have a bad credit score and need funds, just fill our loan application form.

Why is Bank of Baroda Personal Loan best for you?

Bank of Baroda being a prominent bank in India offers multiple benefits to its customers. The major benefits associated with Bank of Baroda Personal loan are listed below. Have a look:-

- Loan available to salaried as well as self-employed professionals

- High quantum loan up to 2 lac

- Flexible loan repayment tenure

- Competitive interest rate

- Low processing fee

- Special loan schemes

- Top-up loan also available

- Part-payment option

- No need of security

Bank of Baroda Bank Personal Loan Interest Rate

Key features of Bank of Baroda Personal Loan

The personal loan provided by Bank of Baroda is easily available in high quantum and that too at low rate of interest so, you can easily meet all your heavy financial needs. Multiple facilities and services are also provided by Bank of Baroda which makes the banking and processing of the loan too easy for the individuals. Below are some of the major highlights of the personal loan offered by Bank of Baroda; have a look:-

Loan available to salaried as well as self-employed professionals

Anyone can easily get the loan from Bank of Baroda as the loan is available to salaried as well as self-employed professionals.

High quantum loan up to 2 lac

You can easily meet your huge funds requirement with Bank of Baroda Personal Loan as the loan up to 2 lac is instantly available in just a few clicks.

Flexible loan repayment tenure

You can easily repay the loan over the time, and the best part is that you can decide the repayment tenure of the loan on the basis of your expected future income.

Competitive interest rate

The interest rates at which Bank of Baroda provides loan is highly competitive so, you can easily get the loan at affordable rates.

Low processing fee

The loan processing fee charged by the bank is quite low and affordable. Thus, you do not have to make a big payment for getting your personal loan approved.

Special loan schemes

Numerous loan schemes are offered by Bank of Baroda to different borrowers so, you might get benefited from their special loan schemes and get loan at minimal rates.

Top-up loan also available

If after taking the loan, you end with some more requirement of funds then just apply for the top-up loan and get cash instantly. Top-up loan option allows you to get some additional funds without taking a new loan.

Part-payment option

You can also clear off your loan by making part payment. If you have the cash in bulk or entire loan amount is not used, then you can instantly pay off your debt by availing part-payment facility.

No need of security

You do not need any security or collateral to get your personal loan approved. Bank of Baroda Personal Loan is provided on basis of your credit score and credit history.

Bank of Baroda Bank Personal Loan Fees & Charges

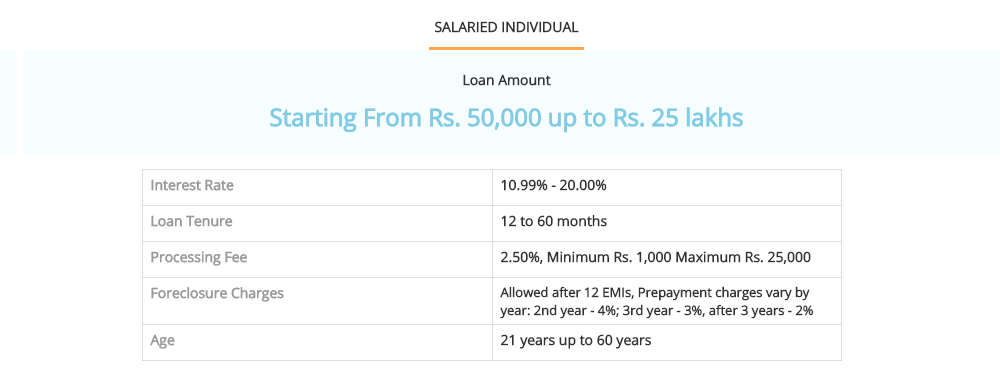

| Loan Processing Fees | Up to 2.50% of loan amount, Rs 1,000 to 25,000 |

|---|---|

| Pre-payment Charges | 4% of principal outstanding - 13 to 24 months, 3% of principal outstanding – 25 to 36 months 2% of principal outstanding - >36 months |

| Penalty for late EMI payment | 24% per year on outstanding amount From default date |

Eligibility for Bank of Baroda Personal loan

In order to apply for Bank of Baroda Personal Loan, you need to be eligible as per their pre-defined norms. The eligibility criteria defined by Bank of Baroda is quite a basic one, scroll down and have a look at the eligibility criteria:-

Your minimum age to apply for the Bank of Baroda Personal Loan is 21 years while the maximum age is 65 years.

You should be the citizen of India, and either a self-employed professional or a salaried employee.

You should either be employed or in business for 2 years and should be in the current employment or business from 1 year.

Your monthly revenue or salary should be more than the minimum income requirement of the bank.

Required Documents for Bank of Baroda Personal loan

In order to get your personal loan approved, you need to provide few documents to the banks. The documents required for Bank of Baroda Personal Loan are listed below. Have a look:-

Application for a loan – You are required to provide a duly filled application for the loan

Residence Proof – Telephone Bill/Passport/Rent Agreement/ Electricity Bills

Income proof – Salary Slip of last 3 months/latest form 16

Identity Proof – Voter ID/ Driving License/PAN Card/ Passport

Statement of Bank – Last 6 months statement of bank

Why to apply for Bank of Baroda Personal Loan at Rupee Station?

At Rupee Station, we make loans available easily and instantly to all the borrowers at the lowest rate of interest. Our aim is to make the entire loan process hassle-free and paperless for the borrowers, so that they can easily meet their financial requirements in a just a few clicks. Rupee Station enjoys collaboration with Bank of Baroda, so you can get the funds in your account in just a couple of days.

You can easily apply for the Bank of Baroda Personal Loan at Rupee Station just by filling our online loan application form. We also help you to avail the best loan offers and schemes provided by the bank, so you can easily get the loan at discounted rates. Below are some of the major advantages of applying for the loan via Rupee Station. Have a look:-

Personalized Loan offers

We completely understand that the requirement of funds varies from borrower to borrower so, to meet the varying requirement of customers Rupee Station offers personalized loan offers. You can easily get a tailor-made loan and meet your requirements.

Apply for loan in a minute

At Rupee Station, you can apply for the loan in just a minute by filling the loan application form at our website. Once you have filled the form, your request for loan is received by our financial experts, who process your application instantly.

Get loan approval instantly

Your loan application is approved on an instant basis, so you need not wait long for getting your loan approved and meeting your financial requirement.

Funds available in only 2 days –

Once your application for the loan is approved, cash is made available to you in just a short span of two days.

Get the support of experts

At Rupee Station, we have a dedicated team of experts to help you with the personal loan procedure. You can get in touch with our experts and get answers to your queries and doubts.

Process to apply for a loan at Rupee Station

At Rupee Station, you can easily apply for a loan in just a minute and avail the funds in just two days. Below is the process of applying for the loan at Rupee Station. Have a look:-

Step 1

Fill your basic details in loan application form at our website.

Step 2

Your loan application is instantly processed and our financial experts will get in touch with you for getting other required information.

Step 3

Get the cash in your account in just two days after the approval of the loan application.