Standard Chartered Bank Personal Loan

Standard Chartered Bank is one of the largest international banks in India and since its inception in 1858; it has never failed to provide best services to its customers. Standard Chartered Personal Loan is available at a competitive rate of interest as well as at customer friendly provisions so, you can easily avail the loan to meet your financial needs.

With Standard Chartered Personal Loan, you can easily meet a wide range of your financial requirements as the loan is a multi-purpose loan as well as available in high amount. Thus, whether you want to pay high medical bills or want to enjoy a world tour Standard Chartered Personal Loan is one of the best options for you.

Why to opt for Standard Chartered Personal Loan?

You can easily apply for Standard Chartered Personal Loan online and get your loan application instantly approved within minutes so; it is one of the best loan options to cater your instant financial needs. In addition, there are numerous other advantages associated with the Standard Chartered Personal Loan; some of them are listed below. Have a look:-

- Loan available for self-employed as well as salaried individuals

- High quantum loan up to 30 lac

- Low rate of interest

- No loan processing fee

- Online loan process

- Flexible repayment option

- Easy documentation procedure

- Pre-closure option available

- No guarantor needed

Standard Chartered Bank Personal Loan Interest Rate

Features of Standard Chartered Personal Loan

Standard Chartered Personal Loans comes with multiple benefits to the borrowers such as easy loan application, competitive interest rates, instant approval, quick disbursal of funds and a lot more. Below listed are few of the key-features of Standard Chartered Personal Loans. Have a look:-

Loan available for self-employed as well as salaried individuals

Standard Chartered Personal Loans is easily available to all the people whether self-employed individual or a salaried employee.

High quantum loan up to 30 lac

You can easily meet your huge fund requirement with Standard Chartered Personal Loans as high quantum loan up to 30 lac is easily and instantly available.

Low rate of interest

The rate of interest charged on the personal loan is quite low so, you can get personal loan at affordable rates starting from 10%.

No loan processing fee

You need not pay a single penny as a loan processing fee. The personal loans are available at zero loan processing charges so, you need not make any payment for getting the loan approved.

Online loan process

The entire loan procedure is made online which makes it convenient for the borrowers to apply for the loan and take follow-ups. You can apply for the loan in a minute just by filling an online application form.

Flexible repayment option

You can easily extend the repayment tenure up to 60 months depending upon your future income. So, if you want to repay the loan in low EMIs, you can easily do the same.

Easy documentation procedure

The documentation process is also a minute task with Standard Chartered Bank as you only need to provide few basic documents. In addition, the verification of documents is also conducted online which makes the process paperless as well as hassle-free.

Pre-closure option available

You can also pay the entire loan amount before the completion of your repayment tenure as Standard Chartered Bank also provides the pre-closure option.

No guarantor needed

You do not need any guarantor for the approval of your Standard Chartered Personal Loan. The loan is approved on the basis of your documents, your credit score, credit history etc.

Standard Chartered Bank Personal Loan Fees & Charges

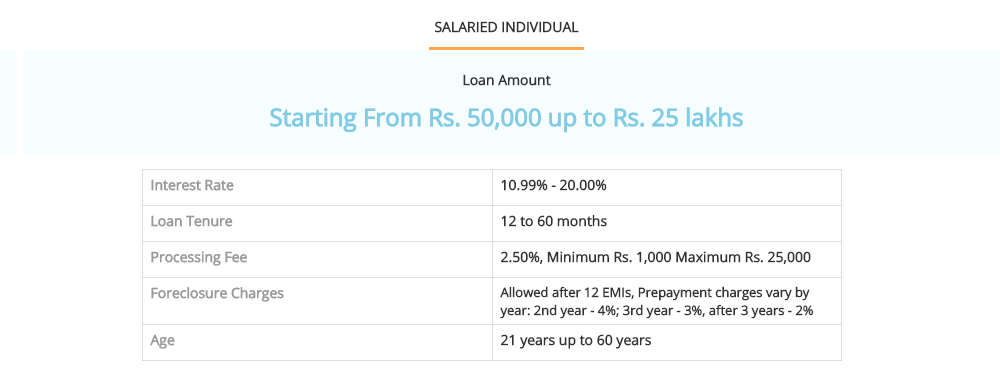

| Loan Processing Fees | Up to 2.50% of loan amount, Rs 1,000 to 25,000 |

|---|---|

| Pre-payment Charges | 4% of principal outstanding - 13 to 24 months, 3% of principal outstanding – 25 to 36 months 2% of principal outstanding - >36 months |

| Penalty for late EMI payment | 24% per year on outstanding amount From default date |

Know your eligibility for Standard Chartered Personal Loan

The eligibility criteria to apply for Standard Chartered Personal Loan is quite a basic one so, anyone can easily apply for the loan. The eligibility criteria for Standard Chartered Personal Loan is given below, check your eligibility –

To avail Standard Chartered Personal Loan, the minimum age limit is 22 while the maximum age limit is 58.

You should either be a salaried employee or a self-employed professional.

You should have a regular source of monthly income.

Your monthly income should be more than the minimum monthly income requirement of the bank which is 60000.

Required Documents for Standard Chartered Personal Loan >

In order to get your loan application approved at Standard Chartered Bank, you are required to provide some of your basic documents for the purpose of verification. Below given are the documents which are required by Standard Chartered Bank for the approval of personal loan application. Have a look:-

Application – You need to provide a duly filled loan application form

Identity Proof –Driving License/Voter ID/Passport

Address Proof –Passport/Electricity Bills/ Rent Agreement/Telephone Bill

Income Proof – Latest salary slip/form16 or latest ITR

Bank Statement – Statement of the bank for last 3 months

Apply for Standard Chartered Personal Loan at Rupee Station

Rupee Station is an online platform for applying all types of loan instantly and easily. At Rupee Station, we aim at providing hassle-free loan experience to the borrowers. You can easily apply for Standard Chartered Personal Loan in just a few clicks at Rupee Station and enjoy the ongoing exclusive loan offers of the bank as we have collaborated with Standard Chartered Bank to provide best services to our customers.

Rupee Station not only allows you to apply for the loan instantly but also allows you to check your credit score, loan eligibility etc. in just a few clicks. In addition, there are numerous other advantages of applying for the personal loan at Rupee Station; know in detail:-

Easy online application

You can easily apply for the loan online with Rupee Station. You just need to fill the simple loan application on our website which demands some basic information.

Quick loan process

The loan procedure is conducted on an instant basis so that you can receive the funds as soon as possible. At Rupee Station, each loan application is taken on a priority basis and the proceedings are conducted instantly.

Low rates of interest

We offer you the personal loan at the lowest rate of interest. Our financial experts process your loan application with different banks, and then offer you the loan amount at the minimum rates.

Cash in just two days

We make the loan amount available to you in just two days so you can easily meet your instant requirement of funds.

Instant assistance of experts

If you have any doubt regarding personal loan or the process of applying for the loan, you can instantly get the assistance of our financial experts. Our experts will guide you as well as will clear all your queries.

Simple steps to apply for a loan at Rupee Station

Applying for a loan has become too easy with Rupee Station; here are the simple steps to apply for the loan. Have a look:-

Step 1

Submit the required information by filling our online loan application form.

Step 2

Our financial experts will review your application instantly and will get in touch with you to proceed further.

Step 3

In next two days, get the loan amount in your account.